Goal 8 / 8.2 / 8.2.1

Does your university pay all staff at least the local living wage?

8.2.1 Does your university as a body pay all staff and faculty at least the living wage, defined as the local ’living wage’ (if government defines this) or the local poverty indicator for a family of four (expressed as an hourly wage)?

Living Wage

Bahrain currently stipulates a minimum wage, of BD400 ($1,061), for Bahraini graduates and BD250 for Bahraini non-graduates (http://www.tradearabia.com/news/edu_220047.html) , (http://www.gdnonline.com/Details/320413/New-Bahraini-minimum-wage-tabled-for-private-sector).

Ahlia university salary scale is in accordance with the Bahrain Labor Law, where It was found that the country with most similar GDP (PPP) per capital with Bahrain is Sweden. Bahrain has per capita income of $51,846, versus a per capita income of Sweden of $51,264. However, taking into account the cost of living adjustment as Stockholm is more expensive than Manama, and using the calculation formula that can be accessed via https://www.numbeo.com/cost-ofliving and inputting the above given of Bahrain and Sweden, the number is adjusted downward by a factor of 1.404. Living wage in Sweden for a family of two plus two (husband/wife plus 2 children) is $1,624.59 (https://wageindicator.org/salary/living-wage/swedenliving-wage-series-january-2018-country-overview).

’Adjusting the minimum wage by the cost of living adjuster, using a conversion factor of 2.63 per BHD, results in a salary of BHD 440.

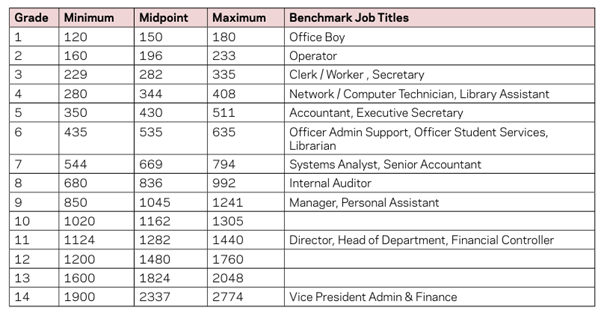

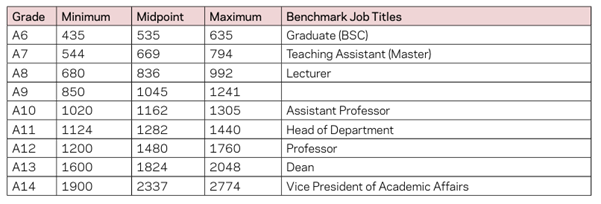

The salary structures have been designed by benchmarking with the University of Bahrain for the academic positions and with the Civil Service Bureau for non-academic positions. Each grade level reflects comparative levels of knowledge, skills, abilities, and responsibilities as well as market forces. The Salary Structures are reviewed on a regular basis to ensure competitiveness with the market. After scanning the payroll at Ahlia University it is an apparent that 98% of employees receive more than BD 440. (SDG8\1 Compensation and Benefit.pdf)

Ahlia University salary scale for all levels across the different employee grades, maintaining an equitable level to attract and retain staff of the caliber required to achieve Ahlia operational objectives inline and above the Government Defined minimum wage.

COMPENSATION AND BENEFITS

https://www.ahlia.edu.bh/human-resources-directorate/

Pdf attached in evidence file

Job Grading

○ All the positions/jobs are classified according to Ahlia job grade structure. These grades form a continuum of importance within Ahlia. The job grade structure is as per pay scale document.

○ Changes in Grade are not permitted within the employee’s probation period.

○ At the time of recruitment the employee shall be assigned a salary according to their grade.

○ All Ahlia unique positions shall be identified, evaluated and classified, in order to recognize the importance of the positions and facilitate creation of a job hierarchy and determination of salaries. However, the salary grades do not in itself create any right to receive annual increments of any specific amount. Annual increments shall be awarded on the basis of the assessed performance of each employee.

○ Aligned to Ahlia grade structure, basic salary ranges and benefits are assigned to each job grade. As job grades and size increase, so do the salary levels related to them.

○ Ahlia present employees and future recruit fitment into Ahlia salary structure (level of compensation for Basic Salary, Job Allowances and Benefits) is dependent upon their fitment into the job grade: Entry, Competent and Experienced levels, depending upon the employees’ experience, skills set, knowledge, current salary, and the market compensation range for the specific position.

○ An employee’s fitment into Ahlia salary structure shall take into account internal parity within the positions in the same job grade and salary band. Any significant changes in the job grade structure shall require a revisit of the salary bands and the ranges therein.

○ For both current and future employees experienced professionals, employee fitment has to be within the job grade assigned to that particular position that the employee is holding currently or is recruited against. Employees having a high level of expertise/experience/job responsibilities shall be near to the maximum range for that grade whereas employees with just sufficient level of expertise/experience/job responsibilities shall be near to the minimum range for that grade.

○ Based on the approval of the President, Ahlia may pay an additional premium over fitment as an aggressive recruitment strategy and enable quick staffing.

○ Ahlia shall monitor salary movements regularly in the competitive market, as pay levels vary from time to time.

Salary Policy

○ The ’basic salary’ consists of a monthly remuneration paid to Ahlia employee for their work, excluding allowances, air ticket allowance, payables for overtime, bonus, commissions, incentives, and other payables. This excludes deductions made in respect of financial assistance, advances, and securities.

○ Ahlia salary components shall have a basic salary component. Basic salary is a fixed component of the total compensation package.

○ An employee's salary may be increased, based on results of a performance appraisal, a promotion, or an exception approved by the President.

○ Ahlia shall set level of compensation for each employee based exclusively on their job grade. Any salary uplifts over the maximum salary applicable for the grade requires approval of the President, irrespective of the percentage of uplift.

○ The salary scale shall be reviewed annually or as and when required, by Ahlia management in accordance with the market demand, in order to be aligned with salaries offered in the local and regional market and to retain key employees of Ahlia and to fairly compensate the new recruits. Amendments made to the salary scales do not imply an immediate increase in the employee's actual salaries.

○ Ahlia employees shall be eligible for Ahlia allowances and benefits following satisfactory completion of the employee’s probation period.

○ If an employee is promoted, the difference between the allowance amounts shall be paid in accordance with the scale for their new position/grade effective from the date of promotion notification.

○ An individual’s level of responsibility is derived from their job description. Thus, it is imperative to understand one’s strategic and operational roles and responsibilities. However, Ahlia may assign additional responsibilities from time to time in line with function operational objectives.

○ Ahlia shall consider following point while determining the employee’s salary:

♦ Clearly defined responsibilities and expectations of each position.

♦ Ensure a consistent compensation and benefits structure continues to exist throughout Ahlia.

♦ Retain the competitive compensation and benefit structure comparable to similar organizations.

♦ Provide a competitive compensation and benefits package to all employees fully, accurately and on time.

♦ Revisit the compensation and benefit structure on a short to long term basis to ensure alignment with the market trends.

♦ Provide performance incentives based on performance and overall contribution in achieving operational objectives.

○ The salaries shall exclude any reimbursement of expenses that have been incurred by employees during the course of operational.

○ An employee proceeding on contractual leave shall be paid salary in advance for the leave period.

○ Ahlia shall provide monthly salary slip reflecting all the transactions on employee request. The salary slip shall reflect all the transactions affecting an employee’s monthly salary.

Fixed Salary

○ Fixed Salary is the monetary compensation provided by Ahlia for an employee’s work effort as agreed in the employment contract. Any amendments to the employee salary from time to time by Ahlia in the form of increments or other salary adjustments approved by President shall be through Ahlia official notification and duly recorded on a Change of Status form.

○ Fixed salary is the composition of the monthly basic salary, housing, and transportation allowances.

○ The salary scale depicts the minimum, median (midpoint), and maximum levels of the basic salary and allowances.

○ The decision to provide the incumbent with the minimum, median, or maximum of the job grade’s basic salary in accordance to the employee's fitment into entry, competent, and experienced levels is that of the concerned Dean/Director in coordination with the President.

Salary Ranges

Pdf attached in evidence file

Salary Ranges for Administrative Positions BD p.m

Salary Ranges for Academic Positions BD p.m.

○ Jobs may be reclassified if significant changes in the responsibilities have occurred. Managers / Department Heads may submit a request to the Human Resources Department to reclassify a particular job giving justifications and changes that have incurred on the job. The Human Resources Department will study the request based on comparison with Benchmark jobs and the level of increased responsibility. Consideration will also be given to market factors, internal equity and the affected employee’s qualifications, seniority, experience, and new level of responsibility.

However, the University reserves the right to limit or reassign job duties rather than approve a proposed job reclassification to a higher grade.

○ To determine the position of current employees or academic faculty across the salary range. The following broad criteria is used:

♦ Employees who are new to the job and who meet the minimum qualification, but might not have the preferred qualification are placed near the minimum.

♦ Employees with the required years of experience and who have mastered the basic intent of the job and perform the duties at a satisfactory level, are placed near the midpoint.

♦ Experienced employees who perform their duties at a consistently high performance level are placed near the maximum.

○ Employees are expected to move along the salary scale within a grade as part of the merit award process as a measure of their performance on the job.

○ For new recruits, the starting salary must not be less than the minimum of the salary range for the grade associated with the employee’s job. Starting salary is determined by considering market factors, internal equity, and the new employee’s qualifications, experience, and responsibility level. As a rule starting salaries should not be over the midpoint of the grade. Exceptions to by-pass this rule must be approved by the President or the Vice President Administration and Finance.

○ When an existing job is reclassified to a higher or lower salary grade, the incumbent’s salary may be adjusted upward or downward in proportion to changes in responsibility. Adjustment upwards will be processed in the next payroll period. Adjustment downward will not be processed in the current contract period but will become effective at the start of the new contract.

Employees, whose salaries reached the maximum of the grade level, are frozen at the grade maximum level until an opportunity arises for promotion to a higher grade job

Broad Criteria

https://www.ahlia.edu.bh/human-resources-directorate/

To determine the position of current employees or academic faculty across the salary range. The following broad criteria is used:

♦ Employees who are new to the job and who meet the minimum qualification, but might not have the preferred qualification are placed near the minimum.

♦ Employees with the required years of experience and who have mastered the basic intent of the job and perform the duties at a satisfactory level, are placed near the midpoint.

♦ Experienced employees who perform their duties at a consistently high performance level are placed near the maximum.

○ Employees are expected to move along the salary scale within a grade as part of the merit award process as a measure of their performance on the job.

○ For new recruits, the starting salary must not be less than the minimum of the salary range for the grade associated with the employee’s job. Starting salary is determined by considering market factors, internal equity, and the new employee’s qualifications, experience, and responsibility level. As a rule starting salaries should not be over the midpoint of the grade. Exceptions to by-pass this rule must be approved by the President or the Vice President Administration and Finance.

○ When an existing job is reclassified to a higher or lower salary grade, the incumbent’s salary may be adjusted upward or downward in proportion to changes in responsibility. Adjustment upwards will be processed in the next payroll period. Adjustment downward will not be processed in the current contract period but will become effective at the start of the new contract. Employees, whose salaries reached the maximum of the grade level, are frozen at the grade maximum level until an opportunity arises for promotion to a higher grade job.

Part Six: Wages

https://www.lmra.gov.bh/en/page/show/199

Article (37):

A worker’s wage shall be fixed according to an individual employment contract, collective employment contract or the employment regulations in the establishment. If the wage is not fixed by any of the aforesaid methods, a worker shall be entitled to wage at a similar rate, if any, otherwise the wage shall be estimated according to the professional practice in the area in which the job duties are performed. If there is no such custom and practice, the competent court shall estimate the wage due to the worker according to the requirements of equity.

The above shall be applicable in deciding the type of service which a worker is required to provide.

Article (38):

A worker’s wage may be calculated by the hour, day, week, month, piece-rate or production.

Wages shall not be deemed to be calculated on a piece-work or production basis unless there is an express provision to this effect in the contract of employment.

Article (39):

It shall be prohibited to discriminate in the payment of wages for the mere difference of sex, ethnic origin, language, religion or belief.

Article (40):

(a) Wages and other amounts payable to a worker shall be paid in the Bahraini legal tender and an agreement may be reached for payment thereof in a legally available foreign currency.

(b) Wages shall be paid on a working day and at the place of work subject to complying with the following:

1. Wages of workers paid at monthly rates shall be paid at least once a month.

2. If wages are paid on a production basis and where the work requires a period of more than two weeks, a worker shall receive in every week a payment on account appropriate to the completed work and the balance of the wage shall be paid during the week following that in which he received the wage for the amount of work already completed.

3. Notwithstanding the aforesaid two sub-clauses, workers’ wages shall be paid at least once in every week unless there is agreement to the contrary.

4. If the employment relationship is terminated, a worker shall be paid his wage and all the amounts due thereto immediately unless the worker has left his employment of his own initiative, in which case the employer shall pay the worker’s wage and all his entitlements within a period not exceeding 7 days from the date of leaving his job.

(c) Subject to the provisions of the aforesaid Paragraph, if an employer delays the payment of wages to a worker beyond the date of payment, he shall compensate the worker at the rate of 6% per annum for the wage whose payment has been delayed for a period of 6 months or less from the date of entitlement to the wage. Such percentage shall be increased at the rate of 1% for each month’s delay thereafter up to a maximum of 12% per annum in respect of such wage.

Article (41):

An employer shall not transfer a worker employment on monthly terms of employment to daily, weekly, piece-work or hourly rate without the written consent of the worker. In such case, the worker shall have all the rights accrued during the period of monthly terms of employment according to the provisions of this Law.

Article (42):

It shall be prohibited for an employer to compel a worker to purchase foodstuffs, goods or services from certain business premises owned thereby or by third parties or from any goods or services produced or provided by the employer.

Article (43):

If a worker reports for duty at the place of employment at the fixed time for performing his duties and where he is willing to carry out his job duties during such period and is not enabled to do so for reasons attributable to the employer, he shall be deemed to have actually carried out his duties and becomes entitled to receive his wage in full.

However, if a worker reports for duty but has been unable to do his work due to reasons beyond the control of his employer, he shall be entitled to one half of his wage.

Article (44):

(a) An employer shall not deduct more than ten percent (10%) of the wage of a worker in repayment of a loan that he may have lent during the continuance of the contract nor shall any interest be charged on such loans. This provision shall be applicable to wages paid in advance.

However, in respect of loans granted for the building of houses, such deduction from the worker’s wage may be increased to a proportion which shall not exceed 25% of the wage, provided that the worker shall confirm his prior agreement in writing to such deduction.

(b) An employer shall be entitled to charge the worker the actual administrative fees and charges due for a loan; and in respect thereof the rules related to the repayment of the loan shall be applicable.

(c) If a worker terminates his employment before repayment of a loan, an employer shall be entitled to deduct the loan amount or the balance remaining thereof from the worker’s entitlements.

Article (45):

No portion of the wage due to a worker shall be attached or assigned except to the extent of 25 percent (25%) of such wage, which percentage may be increased to 50% for the payment of alimony.

In the event of multiplicity of debts, alimony shall receive first priority followed by the amounts due to the employer in respect of any damage caused by the worker to the tools, supplies or payments unlawfully made to him or for the monetary penalties inflicted upon him.

For the assignment of any proportion of the wage to be valid to the extent of the percentage provided for in the first paragraph, the worker’s written agreement shall be obtained.

Article (46):

An employer shall not have discharged his liability for payment of the wage unless the worker concerned signs a register maintained for recording the payment of wages, a payroll or a receipt prescribed for this purpose or by procuring the transfer of his wage to a bank upon the worker’s request.

Article (47):

A worker’s entitlements related to his leaving indemnity, amounts due for balance of annual leave provided for in Article (59) and the compensation due according to the provisions of

Ahlia Competitive Pay

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2021/10/Staff-Handbook_June2021_WEB_4.pdf

Ahlia University values its employees and aims to retain distinguished performers through a package of competitive pay, excellent benefits, a collegial and intellectual environment, and opportunities for career and professional development. Such benefits include airlines tickets for expatriates, tuition fees reimbursements, medical insurance, leave indemnity, social insurance, and all sorts of paid leaves, life insurance, 30 calendar days for administrative staff , total 8 weeks for every full Academic year of service for academic staff & all other leaves as stipulated by the Bahrain Labour Law ’ Housing and other allowances.

SALARY ADMINISTRATION AND COMPENSATION

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2021/10/Staff-Handbook_June2021_WEB_4.pdf

PAY PROCEDURES

1. Full Time Staff

The Employee Relations Division is responsible for preparing salaries, which are paid via bank transfer to Bahraini bank accounts on a monthly basis.

2. Part time Professional Staff

Part time administrative employees are paid monthly based on the number of hours of work put in in a month as agreed in the contract/offer. Payment for the work put in a month is made in the following month. The Employee Relations prepare a payment issue letter once the attendance sheet of the part time administrative employee is signed by his/her direct supervisor.

3. Part time Faculty

Part time faculty is paid per course taught by the end of the semester as agreed on the contract/offer.

The college officer prepares a payment issue letter at the end of each semester.

OVERTIME

’ Overtime work is by definition an allocation of work beyond the required mandatory working hours and should be either in excess of official working hours on a working day, or official holidays or days officially declared as holidays by the university redundant.

’ The Dean/Director concerned shall maintain and approve the overtime register detailing:

- Dates on which the employee has been assigned overtime work

- A breakdown of total hours worked by the employee

- Reasons for overtime

’ The Dean/Director concerned shall forward the overtime register to the HR Directorate for further

processing and payment to the employee before the end of each month.

’ Claim for overtime compensation shall only be made for period of time of work in excess of official duty hours..

’ Incidental or unplanned overtime hours beyond the regular schedule of working hours shall not be treated as authorised work put in as overtime, and the employee shall not be compensated for the same. This includes working hours at the discretion of the employee or their Dean/Director to compensate for time lost due to authorized absence / time off during normal working hours.

’ Employees working more than 36 hours per week (6 hours per day) during the holy month of Ramadan are

eligible for overtime payment subject to the approval from the d Dean/Director concerned.

’ Compensation calculation for overtime would be as per the labour law of Bahrain.

SALARY ADMINISTRATION GUIDELINE

Ahlia University policies include salary scales set for all levels of employees, maintaining an equitable

level, and attracting and retaining staff whose calibre helps the university achieve its operational and

strategic objectives.

New employee

Starting salary is determined through careful consideration of market factors, internal equity, and

the new employee’s qualifications, experience, and responsibility level.

Promotions

’ Faculty promotion follows the academic bylaws for promotion, which are available in

’the university SharePoint.

’ Ahlia University shall consider the following points while awarding promotions to any employee:

- A position becomes available within Ahlia university

- Positions are considered vacant in accordance with the annual approved manpower plan

of the organization

- Consistent good performance

- A distinct increase in duties and responsibilities; and

- The employee possesses the minimum qualifications for the higher position in

consideration or has clearly demonstrated the ability to perform at a higher level,

- An employee must have been with Ahlia University for at least one (1) continuous year

’ All promotions must be approved by the President

EMPLOYMENT STATUS

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2021/10/Staff-Handbook_June2021_WEB_4.pdf

1. Full time employees are those who normally work a minimum of 40 hours per week and are paid monthly salaries with all benefits offered by Ahlia University as specified in their relevant initial offer letters and the contracts of employment.

2. Part time employees are those who are offered employment contracts for the purpose of fulfilling regular vacancies for a specified period of time. Employees in this category are normally paid in lump sum amounts at the end of each month or semester or as agreed in the part time employment contract.

Policy Statements

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2019/06/SM247-HR-manual-Recruitment-section.pdf

Starting salary or base salary for the selected candidate shall be within the salary

’range established for the grade. Candidates with exceptional qualifications, skills,

’experience and / or competencies may be given salary uplift over the salary grade by

’securing prior approval of the President. All salary uplifts over the maximum salary

’applicable for the grade requires approval of the President, irrespective of the percentage of

’uplift.

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2019/06/SM247-HR-manual-Recruitment-section.pdf

Upon selection of the qualified candidates, the HR Director shall be issued an Offer of Employment Form specifying relevant terms and conditions. The offer shall be valid for 15 calendar days from date of issue for local hires, and 30 calendar days for recruits from overseas, within which period the candidate is expected to respond.

The candidate shall be required to join at the earliest date, but not later than 45 days after the date of acceptance of the offer, except those candidates who are required by their present employer to work a longer notice period, and which has been agreed upon the signing of the Letter of Offer, or those employees for which a work visa has to be obtained. A sample Employment contract shall be sent to the candidate for information.

The offer of employment shall at a minimum state the following:

♦ Designation

♦ Grade

♦ Type of contract

♦ Salary and benefits

♦ Employment terms and conditions

Employee Retention

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2021/10/Staff-Handbook_June2021_WEB_4.pdf

Ahlia University values its employees and aims to retain distinguished performers through a package of competitive pay, excellent benefits, a collegial and intellectual environment, and opportunities for career and professional development. Ahlia strives to ensure adequacy of resources and employee grievance resolution mechanisms.

Performance appraisal

https://www.ahlia.edu.bh/cms4/wp-content/uploads/2021/10/Staff-Handbook_June2021_WEB_4.pdf

Performance appraisal is an integral part of the performance management process. Appraisal is done at the end of each year with the purpose of measuring employee performance and encouraging employee development. Findings are used to evaluate merit pay, opportunities for advancement and professional development. It is important to consider the employee’s level of demonstrated performance during the specified review period and how it relates to the definitions of performance ratings, as well as the degree of applicability to the job.

Bahrain Labour Law

https://www.gulftalent.com/repository/ext/Bahrain-Labour-Law.pdf

Chapter 10: Wages (page 18)

Article 66

A wage is the total remuneration whatsoever its nature payable in cash or in kind to a worker by virtue of a written or oral contract of employment in consideration of his employment together with all additional increments and allowances of any kind whatsoever, if any, and, in particular, shall include the following:

1. commission payable to travelling salesmen and commercial representatives.

2. benefits in kind.

3. increments and allowances payable as high cost-of-living or family allowances.

4. any ex-gratia payment to the worker in addition to his wage, bonuses awarded for honesty or efficiency and the like, provided such amounts are contained in the individual contracts of employment or in basic working regulations or, if the granting of such amounts is, by custom and usage, considered by the workers as an element of the wage.

5. Gratuities shall be deemed to be an element of the wage provided its payment is in accordance with customary usage, and governed by rules permitting their accurate calculation.

Article 67

In establishments wherein the wage structure provides for periodical wage increases the most recent basic wage paid to the worker together with high cost of living bonus and family allowance shall be deemed to be the basis for the calculation of the entitlements of such worker in accordance with the provisions of this Law. In other instances, the aggregate of the most recent cash wage paid to the worker periodically and regularly shall be deemed to be the basis for the calculation of wage.

Concerning any worker who is paid a wage on the basis of piece-work or productivity, the calculation in this respect shall be deemed to be upon the basis of the average wage paid to the worker for the actual days worked during the previous three months. Article 68 Wages may be calculated by the hour, day, week, month, piece-rate or production. Wages shall not be deemed to be calculated on a piecework or production basis unless a specific agreement to this effect is expressed in the contract of employment.

Wages shall be paid on a working day at the place of employment in legal tender with due regard to the following:

1. workers paid at monthly rates shall be paid at least once a month.

2. workers paid on an hourly, daily, weekly, piece rate or production basis shall be paid wages at least once in every two weeks.

3. an employer shall not transfer a worker employed on monthly terms of employment to daily, weekly, piecework or production terms of employment, without the consent of the worker concerned and without prejudice to his rights acquired before such transfer.

Article 69

An employer shall not have discharged his liability for payment of the wage to a worker unless the worker concerned signs a register maintained for recording the payment of wages, a pay sheet or a receipt devised for this purpose in establishments operating a mechanized system of wage payment, affirming receipt of such wage or after the lapse of seven days from notifying the worker concerned of the dispatch his wage to the destination of his choice.

Article 70

If the wage for which an employer is liable for payment is not contained in a contract of employment or in the basic work regulations, it shall be calculated for work performed of the same nature. Where no such wage exists, it shall be calculated in accordance with the usage of the occupation and that of the location wherein the employment is performed. If no such usage exists, a judge shall determine the wage according to the exigencies of equity. Similar recourse will be followed in determining the nature of the employment to be performed by a worker.

Article 71

When a worker reports for employment during his hours of work, as required by the contract of employment, or declares that he is immediately available for his employment during the said period and is not enabled to do so for reasons attributable to the employer, he is entitled to be paid his wage for that day.

Article 72

Upon termination of employment, a worker shall be paid immediately his wages and all benefits accruing due to him. However, should he terminate his employment of his own accord the employer is required, in this event, to pay all wages and all benefits due within a period not exceeding seven days from the date the worker terminated his employment.

Article 73

A worker shall not be compelled to purchase foodstuffs or goods from specified establishments, or which are produced by his employer.

Article 74

An employer shall not deduct more than ten per centum of the wage of a worker in repayment of debts or loans due to the employer nor shall any interest be charged on such debts or loans. In respect of loans granted for the building of houses, such deduction from the wage may be increased to a proportion which shall not exceed twenty-five per centum thereof, provided that a prior declaration in writing from the worker concerned authorizing such deduction from his wage within such per centum limitation shall precede the granting of the loan.

Article 75

No portion of the wage due to a worker shall be attached or assigned except to the extent of twenty-five per centum for the payment of alimony or in settlement of the cost of food or clothing and other debts. In the event of the payment of a multiplicity of debts, alimony shall receive first priority within the limitation of one eighth and the remainder shall be available for the other debts. The provisions of this Article and of Article 74 shall be applicable to all sums due to a worker in accordance with Article 66 and Article 111 of this Law.

Article 76

A worker who, by his default causes the loss, damage or destruction of materials, machinery or products, the property of the establishment or in its custody, shall be liable to bear the sum due thereof. The establishment may commence making deductions to recover the said sum from the wage of the worker provided that deduction for this purpose shall not exceed five days' wages in each month. A worker may submit an appeal to the Senior Civil Court within one month from the date of his knowledge of the assessment of value. Where the Court does not rule in favour of the establishment for the recovery or the amount evaluated or for recovery of a lesser value, such establishment shall refund, within seven days' of the date of final decision by the Court, any amount deducted without due cause. The establishment shall not recover its entitlement by way of deduction under this Article if the value of the damage caused by the worker exceeds two months wages.

Article 77

The determination of the minimum standard of wages shall be prescribed by an Order made by the Council of Ministers, having due regard to the submission by the Minister for Labour and Social Affairs.

Bahrain set to revise minimum wages

http://www.tradearabia.com/news/edu_220047.html

Bahrain is considering major changes to the minimum wage system, hoping to scrap informal unified minimum wages in the private sector and replace them with salaries that would depend on people's job titles, said to a top government official.

The existing system states that Bahrainis should receive a minimum salary of BD400 ($1,061) for graduates and BD250 for non-graduates.

The changes are being spearheaded by the Labour Ministry in a bid to significantly cut unemployment rate, make jobs more appealing to Bahrainis and increase Bahrainisation levels in the private sector.

'The minimum wage plan is something that is being reviewed and we are hopeful an announcement will be made soon on this initiative,' said Labour Minister Jameel Humaidan during his monthly majlis yesterday at the ministry's headquarters in Isa Town.

'We will take into consideration the academic qualifications and based on this the minimum wage will be set.'

Humaidan stressed the importance of increasing the Bahrainisation quota as it reduces the unemployment rate and decreases dependence on foreign workers.

'The unemployment rate is about 3.8 per cent,' he added. 'Now we are focusing on the qualitative aspect of Bahrainisation, but in the future we shall include the quantitative.'

He said the ministry played a key role in reinstating sacked workers and it was now focusing on improving Bahrainisation, including increasing training programmes for Bahrainis to integrate them in the workforce.

The majlis was attended by businessmen, MPs, officials and representatives from the Bahrain Chamber of Commerce and Industry and General Federation of Bahrain Trade Unions.

They discussed a royal decree that places multiple unions under one organisation. Unionists claimed the move would divide workers, but supporters of the decree explained it would ensure trade unions were not monopolised.

'I have suggested forming a legal team within the ministry consisting of neutral members to study the case of multiple unions to deal with the issue,' responded Humaidan.

In March, the minister said they were revising the Bahrainisation quota in a number of sectors and a new percentage would be released based on the job and number of employees in each sector. ’ TradeArabia News Service

Copyright 2024 © All rights Reserved. Ahlia University